inheritance tax rate kansas

The sales tax rate in Kansas for tax year 2015 was 615 percent. As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax which has a maximum rate of.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate tax of 08 percent to 16 percent on estates above 4 million.

. State and local sales taxes here are also lower than the national average and there are no estate or inheritance taxes either. As mentioned previously the probate process in Kansas typically takes anywhere from eight months to three years to finalize. The top inheritance tax rate is18 percent exemption threshold.

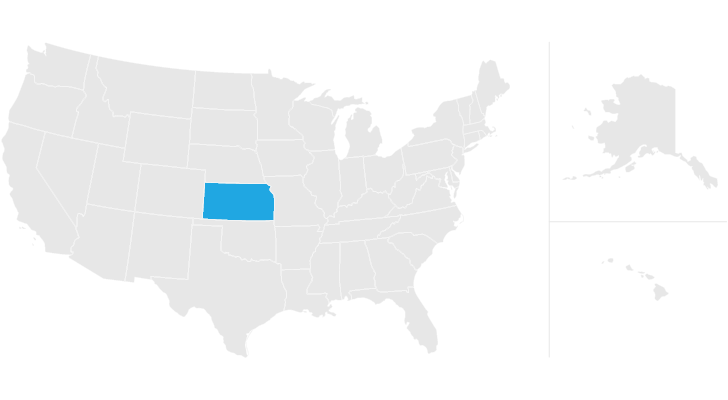

The surtaxes are generally uniform. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. For more information on these and other Kansas state taxes see the Kansas State Tax Guide.

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. These surtaxes cumulatively raised approximately 24 million in 2008.

Kansas does not have these kinds of taxes. The Federal Estate Tax changes rather frequently. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

Also Kansas residents who inherit from Kansas estates or estates in other states need to understand inheritance tax because they may be responsible for paying an inheritance tax when they collect an inheritance. Estate tax of 10 percent to 20 percent on estates above 55 million. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

The state has a progressive income tax with rates ranging from 310 to 570. The District of Columbia moved in the. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

Inheritance Estate Tax. In this detailed guide of the inheritance laws in the Sunflower State we break down intestate succession probate taxes what makes a will valid and more. Very few people now have to pay these taxes.

The standard Inheritance Tax rate is 40. The federal estate tax is calculated on the value of the. Kansas taxes Social Security income only for those with an Adjusted Gross Income over 75000.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Kentucky Inheritance and Estate Tax Laws can be found in the Kentucky Revised Statutes under Chapters. In this detailed guide of the inheritance laws in the sunflower.

The statewide sales tax rate in Kansas is 650. No city or township has a rate higher than 225 and 36 have a lower rate as low as 025. Note that historical rates and tax laws may differ.

County taxes is 075 and city and township taxes are 225. With city and county taxes the average sales tax rate is 862 and can. The state property taxes average 140 making it one of the higher rates in the country.

Estate tax of 8 percent to 12 percent on estates above 58 million. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. State Inheritance tax rate.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. In 2018 the Federal Estate Tax Exemption was increased under the Tax Cut and Jobs Act.

No estate tax or inheritance tax. Inheritance tax of up to 15 percent. Its only charged on the part of your estate thats above the threshold.

State inheritance tax rates in 2021 2022. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. The top estate tax rate is 16 percent exemption threshold.

Inheritance and Estate Taxes are two separate taxes that are often referred to as death taxes since both are occasioned by the death of a property owner. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of march 2013. The increased exemption is only in effect until January 1 2026 unless Congress passes a new law.

A strong estate plan starts with life insurance. All Major Categories Covered. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

Ad Instant Download and Complete your Will Forms Start Now. Select Popular Legal Forms Packages of Any Category. The exemption rate almost doubled to 117 million for individuals and 234 million for married couples.

Inheritance tax of up to 16 percent. Your estate is worth 500000 and your tax-free threshold is. This increases to 3 million in 2020 Mississippi.

California has the highest marginal tax rate which combines both federal and state capital gains of 373 followed by Oregon 349 and Minnesota 3485. The state sales tax rate is 65. No estate tax or inheritance tax.

The state has a relatively high property taxes. Kansas residents do not need to worry about a state estate or inheritance tax. No estate tax or inheritance tax.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. Connecticuts estate tax will have a flat rate of 12 percent by 2023. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

Inheritance and Estate Taxes. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. If you want professional guidance for your estate plan SmartAssets free financial.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. Over 10000 to 20000.

And there is a maximum federal estate tax rate of forty percent. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process. There is no federal inheritance tax but there is a federal estate tax.

In this detailed guide of the inheritance laws in the Sunflower.

Kansas Estate Tax Everything You Need To Know Smartasset

State Tax Levels In The United States Wikiwand

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Health Legal And End Of Life Resources Everplans

State Death Tax Is A Killer The Heritage Foundation

Kansas Income Tax Calculator Smartasset

Does Kansas Charge An Inheritance Tax

Kansas Is One Of The Least Tax Friendly States In The Us Kake

Kansas State 2022 Taxes Forbes Advisor

States With Highest And Lowest Sales Tax Rates

The New Death Tax In The Biden Tax Proposal Major Tax Change

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Historical Kansas Tax Policy Information Ballotpedia

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas Inheritance Laws What You Should Know

Retiring In These States Will Cost You More Money Vision Retirement

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation